The Future of RCS Service + Inspiring RCS Message Examples

Text messages are no longer just plain words. With the help of RCS Service, brands can now send colorful...

Learn more

Banking has always been quick to embrace technology to better serve customers. From ATMs to mobile banking apps, every bit of innovation has changed how customers interact with their banks. Today’s consumers are more demanding than ever — they expect speed, convenience, personalization, and most importantly security.

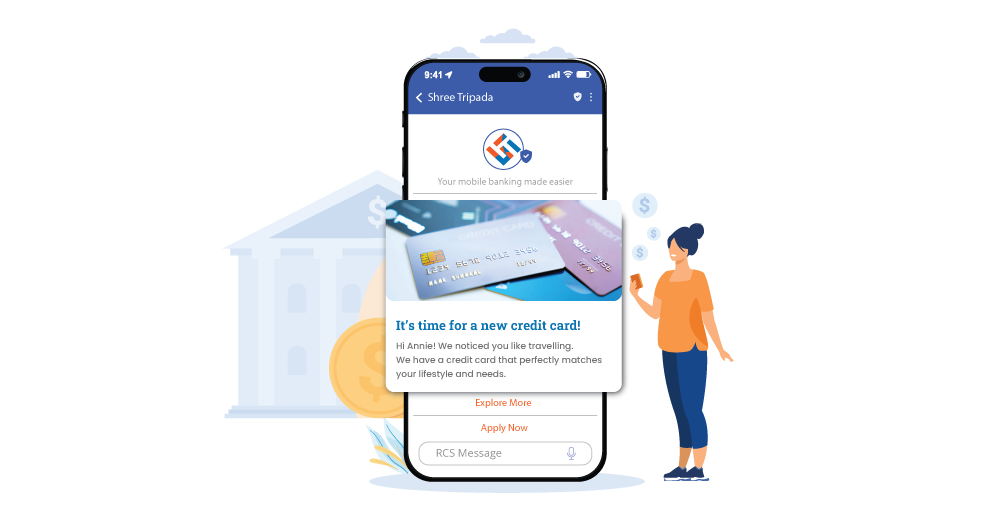

This is where RCS (Rich Communication Services) Business Messaging steps in – a merger between the simplicity of SMS and the richness of contemporary app-style experiences that can revolutionize the financial industry.

RCS Business Messaging is the next generation of SMS. Unlike standard bulk SMS services, RCS allows banks to deliver branded, interactive and even media rich messages to customers through their native messaging app of choice.

Verified business profiles, interactive buttons, and multimedia support are some of the features RCS provides to banks to create engagement experiences rather than just transactions but engaging and secured.

Banking customers want simplicity. They don’t want to switch back and forth between a variety of apps to get things done. At the same time, they require trust and security in all their transactions.

RCS provides:

It is expected that by 2025, banks will confront stiff competition not only from legacy players, but also from nimble fintech providers. In this new world order, frictionless, safe, and interactive communication will be the differentiator.

Here’s how RCS is revolutionizing banking communication:

RCS, unlike simple plain SMS, could include images, videos, carousels and even documents. It’s how banks can send you an attractive account update, loan offer, or investment tip. It not only enhances the appeal of communication but also contributes to a unique customer journey.

Using RCS, banks can now show their verified business name, logo, and a checkmark, enabling customers to trust the SMS before they even open it. It goes a long way toward mitigating phishing threats and establishing more trust in the digital banking channel.

With traditional SMS, messages are limited to 160 characters with banks frequently having to break up key information. RCS breaks down this barrier, enabling banks to deliver full information – from policy changes to transaction summaries – in one stick, easy-to-read message.

RCS has interactive buttons such as ‘Pay Now’, ‘Book Appointment’, or ‘Apply for Loan’. From the message, customers can instantly act, cutting down on friction and increasing conversion rates.

| Feature | SMS | RCS Business Messaging | Impact for Banking |

|---|---|---|---|

| Branding | No | Yes (logo, name, verified checkmark) | Builds trust & recognition |

| Multimedia Support | No | Yes (images, video, carousels, docs) | Rich, engaging experiences |

| Interactivity | No | Yes (buttons, quick replies, CTAs) | Seamless customer actions |

| Read Receipts | No | Yes | Better engagement insights |

| Verified Sender | No | Yes | Reduced fraud & phishing |

| User Experience | Basic text | App-like interface | Meets modern customer expectations |

| Message Length | 160 characters | Unlimited | Enables detailed communication |

| Analytics | Basic delivery reports | Full engagement tracking | Data-driven decision making |

The banking environment is changing, and customers are looking for more individualized, safer, and more interactive communication. SMS has long been the go-to, but it’s fraught with limitations such as plain text only, low character count and security issues.

This is where RCS (Rich Communication Services) comes in — the next-generation messaging channel designed to bridge the gap between the simplicity of SMS and the richness of modern chat apps.For banks, RCS isn’t just a tool for sending alerts — it’s a way to create holistic digital experiences that engage customers, improve trust, and drive instant action.

Following are some of the most meaningful RCS use cases in banking:

1. Balance & Transaction Alerts – with Branding & VerificationInstead of just SMS updates, banks can send RCS alerts with the bank’s logos, name and a verification badge. That way, customers instantly know who sent a text and there’s no question of phishing. Now a balance update or transaction alert can be visually branded, secure and much more exciting.

Example: “Your salary of ₹50,000 has been credited to your account” with the bank logo and a quick CTA to “View Statement.”

2. Loan & Credit Card Offers – in Carousel FormatBanks usually advertise products such as loans and credit cards through SMS campaigns, but text-only promotions hardly have an impact. “With RCS, banks can provide carousel-style offers with pictures of the product, the benefits and the ability to apply in one click with a ‘Apply Now’ button.

Example: A carousel showing “Home Loan at 8%,” “Personal Loan in 10 mins,” and “Credit Card with Cashback Benefits,” each with its own CTA.

3. KYC & Document Reminders – with Instant ActionsKYC compliance is compulsory, yet most of the customers delay their updates when they get SMS reminders. RCS makes this easier by providing reminders with quick-reply buttons such as “Upload Now” or “Verify ID.” Customers could take a action immediately without visiting a branch or logging into a different app.

Example: “Your KYC is pending. Please upload your Aadhaar or PAN.” [Upload Now] button included inside the message.

4. Bill Payments & EMI Reminders – with Payment IntegrationLate payments are bad for both customers and banks. RCS fixes this issue by using interactive payment reminders which includes options to pay bills and EMIs directly through the message. Users are no longer having to log in to apps — they can actually complete payments in seconds.

Example: “Your EMI of ₹5,000 is due on 10th September.” Message includes [Pay Now] or [Set Reminder] buttons.

5. Customer Support via AI-Powered ChatbotsChatbots can also have two-way conversations in RCS, while SMS is one way. Banks can embed AI-driven virtual assistants to respond to routine requests such as “Check Balance,” “Block Card” or “Get Loan Info.” This takes the burden off call center and results in 24/7 immediate support.

Example: A customer types “Lost Card” and instantly gets guided steps with a button to “Block Card Immediately.”

With these use cases, RCS turns banking communication from basic updates into interactive experiences. Customers don’t view messages as one-way notifications, but as two-way conversations where they can take action immediately. All of this increases satisfaction, reduces fraud and helps build lasting trust in digital banking.

For banks, implementing RCS is more than a task of upgrading the technology solution: It’s an investment in the future.

It’s no longer about banking transactions; it’s about fostering trust, engagement and long-term relationships with customers. RCS Business Messaging allows banks to deliver on this promise by providing rich interactive experiences with security features that are tailor-made and carry abundant value directly on the user’s native messaging app.

As digital banking evolves, RCS is set to become the gold standard for communication—making banking smarter, safer, and more engaging than ever. Partnering with a trusted provider like Shree Tripada, banks can seamlessly adopt RCS solutions to stay ahead of the curve and deliver next-gen customer experiences.

Text messages are no longer just plain words. With the help of RCS Service, brands can now send colorful...

Learn more

Today, many businesses use a new kind of message called RCS. It’s like a fancy text message...

Learn more

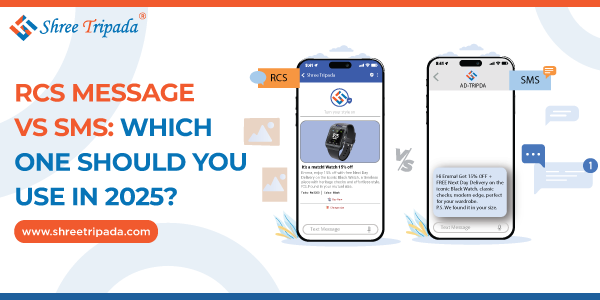

Text messages are like little notes we send on phones. There’s an old way called SMS...

Learn more

In 2025, regular SMS may not be enough to meet what customers expect from businesses...

Learn more

RCS Messaging is about to change the way we communicate. Text messaging is now being upgraded!...

Learn more

RCS Chat means a new and improved messaging service that offers more features than regular SMS....

Learn moreShree Tripada Infomedia India Private Limited

Corporate Head Office:

706 , 7th Floor , North Plaza, Nr 4D Square mall, Beside PVR, Opp Palladium

Nr.Visat Circle ,Motera, Sabarmati, Ahmedabad, Gujarat 380005